SERVICES FOR ASSET MANAGERS

Maximum control, minimum complications. Designed for collective investment and pension fund managers.

Maximum control, minimum complications. Designed for collective investment and pension fund managers.

Flexibility

Continuity, commitment, trust

Control and Supervision. Highly specialised team in Spain

Unique customer relationship dialogue

Team specialised in the relationship with Venture Capital managers

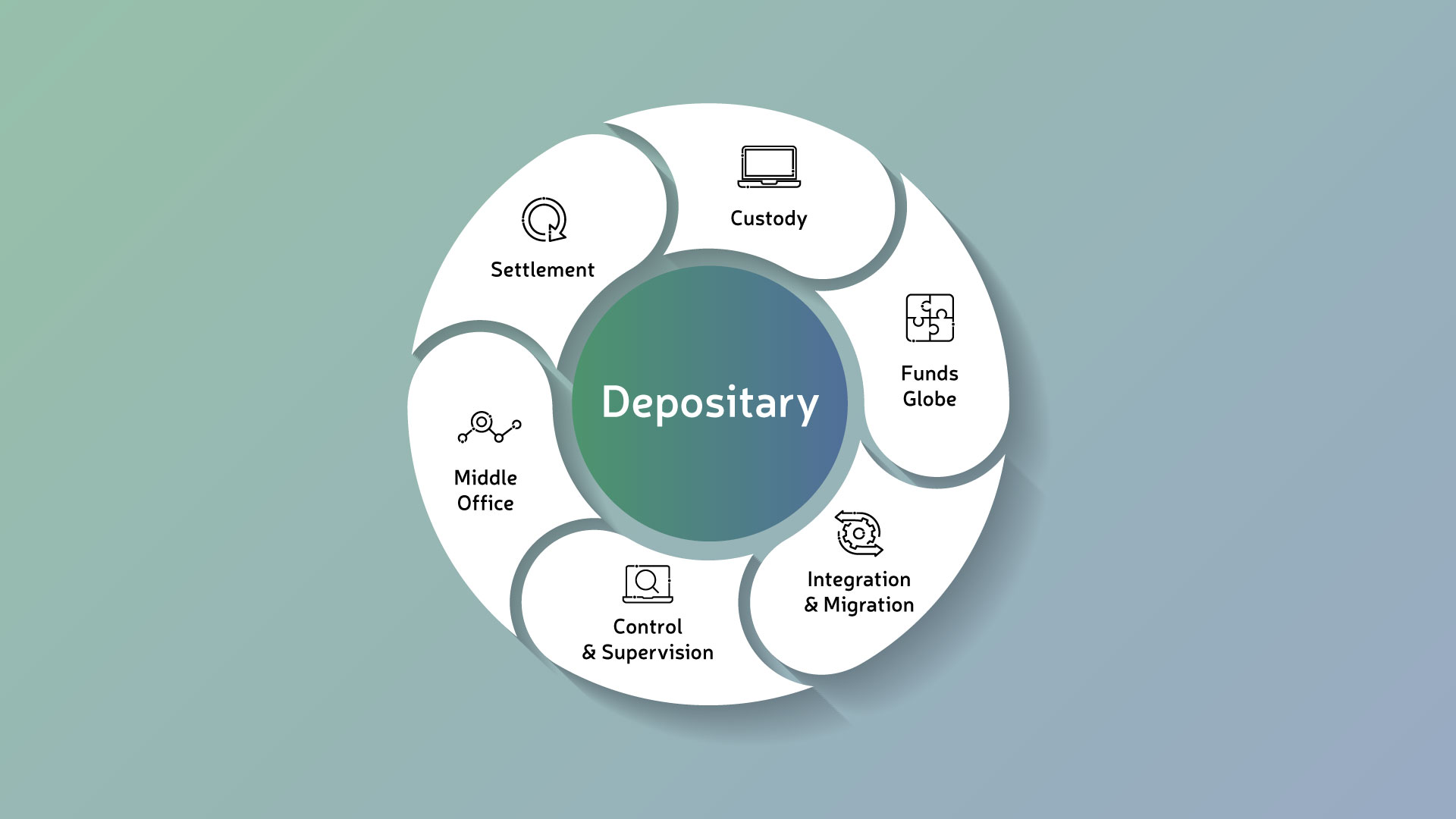

Through our strategic alliance with ADEPA, in which Inversis holds a 40% stake, we offer a fund administration service based on a multilevel integration approach to guarantee high quality operations in each type of portfolio: UCITS, Alternative Investment Funds, Individual Portfolios...

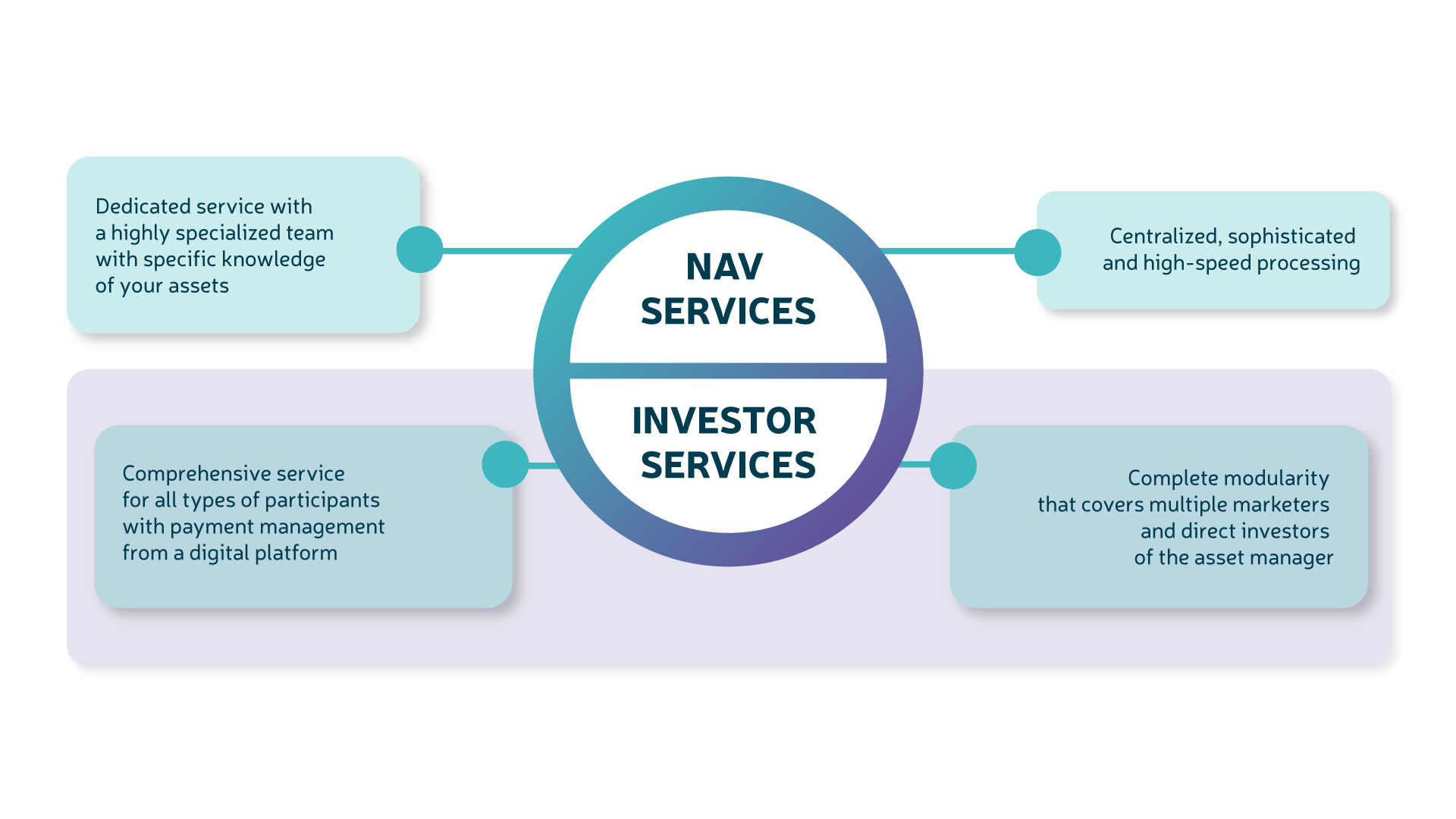

Our position as a specialist in outsourcing services and as a 100% institutional fund distribution platform allows us to offer a turnkey solution full of advantages for both national fund managers and marketers.

Our experience and proven solvency as a team of specialists and our back office allows us to offer this service in an outsourcing model with the following competitive advantages:

BENEFITS FOR NATIONAL FUND MANAGERS

ADVANTAGES FOR MARKETERS